A Complete Guide to Car Insurance for Small Business Owners in America

A Complete Guide to Car Insurance for Small Business Owners in America: Navigating the world of commercial auto insurance can feel overwhelming, especially for small business owners juggling countless responsibilities. This guide cuts through the jargon, providing clear, concise information to help you secure the right coverage at the best price. From understanding different policy types to managing claims effectively, we’ll equip you with the knowledge to protect your business and your bottom line.

Protecting your company vehicles and employees is crucial for any small business. This guide will walk you through every step, from assessing your insurance needs and obtaining quotes to understanding policy documents and managing claims. We’ll also explore ways to save money, navigate state-specific regulations, and handle high-risk situations. Ultimately, our goal is to empower you to make informed decisions about your commercial auto insurance.

Table of Contents

ToggleTypes of Car Insurance for Small Businesses

Protecting your business vehicles is crucial for maintaining operations and mitigating financial risks. Choosing the right car insurance policy involves understanding the various coverage options available and selecting the best fit for your specific needs and risk tolerance. This section details the common types of car insurance coverage for small businesses in the United States.

Liability Coverage, A Complete Guide to Car Insurance for Small Business Owners in America

Liability insurance protects your business from financial losses resulting from accidents you cause. It covers bodily injury and property damage to others. For example, if your employee causes an accident resulting in injuries and damage to another vehicle, liability insurance would cover the medical bills, vehicle repairs, and legal fees associated with the incident. The limits of your liability coverage are expressed as a three-number combination (e.g., 25/50/25), representing the maximum amount your insurer will pay per person injured, per accident for all injured persons, and per accident for property damage, respectively.

Failing to carry sufficient liability coverage can lead to significant personal financial liability if the damages exceed your policy limits.

Collision Coverage

Collision coverage pays for repairs or replacement of your business vehicle if it’s damaged in an accident, regardless of who is at fault. This is crucial for protecting your business investment in vehicles. If your company van is involved in a collision, even if you are at fault, collision coverage will help cover the costs of repairs or a replacement vehicle, minimizing business disruption.

However, collision coverage typically has a deductible, meaning you’ll pay a certain amount out-of-pocket before the insurance kicks in.

Comprehensive Coverage

Comprehensive coverage protects your business vehicles against damage caused by events other than collisions, such as theft, vandalism, fire, hail, or weather-related damage. Imagine a hailstorm causing significant damage to your company fleet; comprehensive coverage would help cover the repair or replacement costs. Like collision coverage, comprehensive insurance typically has a deductible.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident caused by an uninsured or underinsured driver. It can cover your medical expenses, vehicle repairs, and lost wages. Given the prevalence of uninsured drivers in many parts of the US, this coverage offers critical protection for your business and employees. It’s essential to ensure that your policy’s limits are adequate to cover potential losses.

Medical Payments Coverage

Medical payments coverage helps pay for medical expenses for you, your employees, and passengers in your vehicle, regardless of fault. This coverage can be especially important for businesses that frequently transport employees or clients. Even if the other party is at fault, medical payments coverage provides a quicker and simpler path to covering immediate medical needs, avoiding protracted legal battles over fault determination.

Comparison of Common Small Business Car Insurance Types

| Coverage Type | Coverage | Cost Factors | Benefits |

|---|---|---|---|

| Liability | Bodily injury and property damage to others | Policy limits, driving record, type of vehicle | Protects against significant financial losses from accidents you cause. |

| Collision | Damage to your vehicle in an accident, regardless of fault | Vehicle value, deductible, driving record | Covers repairs or replacement of your damaged vehicle. |

| Comprehensive | Damage to your vehicle from non-collision events (theft, fire, etc.) | Vehicle value, deductible, location | Protects against a wide range of non-collision damage. |

| Uninsured/Underinsured Motorist | Damage caused by an uninsured or underinsured driver | Policy limits, state regulations | Essential protection in case of accidents with at-fault uninsured drivers. |

Determining Insurance Needs

Source: nerdwallet.com

Choosing the right car insurance for your small business requires careful consideration of several key factors. Failing to accurately assess your needs can lead to inadequate coverage, leaving your business vulnerable to significant financial losses in the event of an accident or other incident. A thorough evaluation will ensure you have the appropriate protection without overspending on unnecessary coverage.Understanding your specific circumstances is crucial.

This involves analyzing your fleet, employee driving habits, business operations, and geographic location to determine the level of risk your business faces. By accurately identifying these risk factors, you can select a policy that effectively mitigates potential liabilities and protects your assets.

Factors Influencing Insurance Needs

Several factors significantly impact the type and amount of car insurance a small business needs. The number of vehicles in your fleet directly correlates with your risk exposure. More vehicles mean a higher probability of accidents and thus, potentially higher insurance premiums. The types of vehicles also matter; larger trucks or vans generally command higher premiums than smaller cars due to increased repair costs and higher potential for damage.

Employee driving presents another layer of complexity. The driving records of your employees, their commuting distances, and the frequency of business-related driving all influence the risk assessment. The nature of your business activities – frequent long-distance travel versus primarily local deliveries – impacts the likelihood of accidents. Finally, geographic location plays a role; areas with high accident rates or theft rates will typically result in higher premiums.

Risk Assessment for Small Businesses

Accurate risk assessment is paramount. This involves analyzing historical data on accidents, traffic violations, and vehicle maintenance records. Regular vehicle maintenance reduces the likelihood of mechanical failures leading to accidents. Implementing driver training programs can improve driving habits, minimizing risky behaviors and potential accidents. Analyzing the types of roads your vehicles frequently travel on (e.g., highways versus city streets) helps insurers assess the risk profile.

Companies with a history of accidents will likely face higher premiums. For example, a landscaping business with frequent off-road driving will face different risks compared to a courier service operating primarily in urban areas.

A Complete Guide to Car Insurance for Small Business Owners in America covers many aspects of protecting your company vehicles. One crucial decision is whether to add roadside assistance, a question many ponder. To help you decide, check out this helpful article: Is It Worth Paying for Roadside Assistance Coverage in Your Car Insurance? Returning to our guide, remember that comprehensive coverage is vital for business vehicles, minimizing downtime and financial losses.

Assessing the Value of Company Vehicles

Accurately determining the value of your company vehicles is crucial for securing appropriate coverage. Using the vehicle’s purchase price isn’t always sufficient. Depreciation needs to be considered. Several methods exist for determining value, including checking online resources like Kelley Blue Book or Edmunds, which provide estimates based on make, model, year, and mileage. Obtaining appraisals from independent vehicle assessors provides a more precise valuation, especially for older or specialized vehicles.

Maintaining detailed records of vehicle maintenance and repairs can support your claim in the event of damage or loss. For example, a well-maintained five-year-old van might be valued higher than a similarly aged van with a history of neglect. Accurate valuation ensures you’re not underinsured and prevents disputes with your insurer in the event of a claim.

Obtaining Quotes and Comparing Policies

Getting the best car insurance for your small business requires more than just picking the first quote you see. Shopping around and comparing policies is crucial to finding the right balance of price, coverage, and reliable service. This involves a systematic approach to ensure you’re making an informed decision.The process of obtaining quotes and comparing policies involves several key steps.

Understanding these steps will empower you to find the most suitable and cost-effective insurance for your business needs. Remember, the goal is to secure comprehensive coverage without overspending.

Obtaining Car Insurance Quotes

To obtain car insurance quotes, you’ll need to gather some basic information about your business and your vehicles. This typically includes the make, model, and year of each vehicle, your business’s address, the number of drivers, and your driving history. Many insurers offer online quote tools, allowing you to quickly input this information and receive an immediate estimate. Alternatively, you can contact insurance providers directly via phone or email.

Be prepared to answer questions about your business’s operations, such as the types of vehicles used and their typical mileage. It’s recommended to get quotes from at least three to five different insurers to ensure a broad comparison.

Comparing Car Insurance Policies

Comparing policies goes beyond simply looking at the price. While cost is a significant factor, you also need to carefully examine the coverage offered by each insurer. Consider factors such as liability limits, collision and comprehensive coverage, uninsured/underinsured motorist protection, and any additional endorsements that might be relevant to your business, such as hired and non-owned auto coverage. Customer service ratings are also critical; a low price is meaningless if you can’t easily file a claim or get assistance when needed.

A Complete Guide to Car Insurance for Small Business Owners in America covers many aspects, from choosing the right coverage to managing costs. However, a key consideration, especially if your drivers have past violations, is understanding how to minimize premium increases. Check out this helpful guide on How to Lower Your Car Insurance Premiums After a Traffic Violation in the U.S.

to better manage your business’s insurance expenses. Returning to our guide, remember that proper risk management is crucial for securing the best rates for your small business.

Websites like J.D. Power and the Better Business Bureau often provide independent ratings of insurance companies.

A Step-by-Step Guide to Comparing Car Insurance Quotes

- Gather Necessary Information: Compile all the required details about your vehicles and business operations. This will streamline the quote-gathering process.

- Obtain Quotes from Multiple Insurers: Use online quote tools or contact insurers directly to obtain at least three to five quotes. Ensure you’re comparing apples to apples—meaning the same coverage levels.

- Analyze Coverage Details: Carefully review each policy’s coverage details. Don’t just focus on the premium; understand the limits and exclusions of each policy. Look for specific coverages relevant to your business operations.

- Compare Prices: Once you understand the coverage, compare the premiums. Note that the lowest price isn’t always the best deal if the coverage is insufficient.

- Check Customer Service Ratings: Research the insurers’ customer service reputations. Look for reviews and ratings from independent sources to gauge the ease of filing claims and overall customer satisfaction.

- Consider Additional Factors: Evaluate factors like discounts, payment options, and the insurer’s financial stability. A financially strong insurer is less likely to default on claims.

- Make an Informed Decision: Based on your analysis, choose the policy that best balances price, coverage, and customer service.

For example, comparing a policy with a $100,000 liability limit to one with a $300,000 limit is crucial, even if the higher limit costs more. The added protection could significantly impact your financial well-being in the event of an accident. Similarly, a slightly higher premium for a company known for excellent customer service might be worth it to avoid potential frustrations during the claims process.

Understanding Policy Documents

Your small business car insurance policy is a legally binding contract. Understanding its contents is crucial for ensuring you have the right coverage and avoiding unexpected costs. This section will break down the key components of a typical policy document.

A standard small business car insurance policy usually includes several key sections. Familiarizing yourself with these will empower you to make informed decisions and avoid potential misunderstandings.

Declarations Page

The declarations page is the summary of your policy. It contains essential information like your name, business name, policy number, covered vehicles (including VIN numbers and descriptions), policy period, premium amount, and the limits of your coverage. This page serves as a quick reference for your policy’s most important details. Think of it as the policy’s table of contents.

It’s the first place to look for basic information about your insurance.

Coverage Details

This section Artikels the specific types of coverage included in your policy. It will detail the limits of liability for each type of coverage (e.g., bodily injury liability, property damage liability, collision, comprehensive, uninsured/underinsured motorist). It also explains what situations each coverage applies to. For example, the collision coverage section will specify what is covered in case of an accident involving another vehicle or object.

A Complete Guide to Car Insurance for Small Business Owners in America helps you navigate the complexities of protecting your company vehicles. Understanding the different coverage options is key, so it’s helpful to first clarify the basics: check out this guide on What’s the Difference Between Full Coverage and Liability Insurance in the U.S.? to make informed decisions.

This knowledge will then allow you to choose the best car insurance policy for your specific business needs and budget.

This part of the policy explains exactly what is and isn’t covered by your insurance.

Exclusions

The exclusions section details what is specificallynot* covered by your policy. Understanding these exclusions is just as important as understanding your coverages. Common exclusions might include damage caused by wear and tear, intentional acts, or driving under the influence of alcohol or drugs. Ignoring these exclusions could lead to significant out-of-pocket expenses if a covered incident occurs.

Examples of Common Policy Exclusions and Their Implications

Let’s look at a few examples of common exclusions and their potential consequences:

| Exclusion | Implication |

|---|---|

| Damage caused by wear and tear | A flat tire due to normal wear and tear is unlikely to be covered. You would have to pay for the repair or replacement yourself. |

| Driving while intoxicated | If you cause an accident while driving under the influence, your insurance may deny coverage, leaving you responsible for all damages and potential legal fees. |

| Using your vehicle for unauthorized purposes | If your policy specifies business use only, and you use the vehicle for personal reasons resulting in an accident, your claim might be denied. |

Conditions

The conditions section Artikels the responsibilities and obligations of both you (the insured) and the insurance company. These conditions often involve things like timely notification of accidents, cooperation with investigations, and maintaining accurate records. Failure to comply with these conditions could affect your claim.

Common Policy Terms and Their Meanings

Here’s a table defining some common terms you’ll encounter in your policy document:

| Term | Meaning | Example |

|---|---|---|

| Liability Coverage | Covers bodily injury or property damage caused by you to others. | If you cause an accident that injures someone, liability coverage pays for their medical bills. |

| Collision Coverage | Covers damage to your vehicle from an accident, regardless of fault. | If you hit a tree, collision coverage will help pay for repairs to your vehicle. |

| Comprehensive Coverage | Covers damage to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters. | If your vehicle is stolen, comprehensive coverage will help replace it. |

| Deductible | The amount you pay out-of-pocket before your insurance coverage kicks in. | If your deductible is $500 and your repair costs $1,500, you pay $500, and insurance pays $1,000. |

| Premium | The amount you pay regularly for your insurance coverage. | Your monthly or annual payment to maintain your insurance. |

Managing Insurance Claims

Navigating the insurance claims process can be stressful, especially for small business owners. Understanding the steps involved and anticipating potential issues can significantly ease the burden and ensure a smoother resolution. This section details the process of filing a claim, common reasons for denial, and strategies for effective communication with your insurer.Filing a car insurance claim for your small business generally involves several key steps.

First, you’ll need to report the incident to your insurance company as soon as possible, ideally within 24-48 hours. This initial report sets the claims process in motion.

Claim Filing Process

Following the initial report, you’ll be assigned a claims adjuster who will guide you through the process. You will need to provide comprehensive documentation to support your claim. This typically includes a completed claim form, copies of your driver’s license and vehicle registration, police reports (if applicable), photos and videos of the damage, and any relevant medical records or repair estimates.

Be meticulous in gathering and submitting this information; incomplete documentation can significantly delay the process. The adjuster will investigate the claim, potentially requesting further information or conducting an inspection of the vehicle. Once the investigation is complete, the insurance company will determine liability and issue a settlement.

Reasons for Claim Denials

Claims are sometimes denied, often due to preventable factors. For example, a claim might be denied if the damage is deemed pre-existing, if the policy doesn’t cover the type of incident, if the driver was at fault and not insured under the policy, or if the claim is deemed fraudulent. Failing to promptly report the incident, providing inaccurate information, or not cooperating with the investigation can also lead to denial.

Furthermore, policy exclusions, such as those related to driving under the influence or using the vehicle for unauthorized purposes, can result in a denied claim. For instance, if your business policy explicitly excludes off-road driving and an accident occurs while off-roading, your claim might be rejected.

Effective Communication with Insurers

Maintaining clear and consistent communication with your insurance provider is crucial. Respond promptly to all requests for information, and keep detailed records of all communication, including dates, times, and the names of individuals you spoke with. If you disagree with the insurer’s assessment, clearly and respectfully explain your perspective, providing supporting documentation. Consider keeping a detailed log of all communications, including emails, phone calls, and letters.

This record will be invaluable if disputes arise. Remember, maintaining a professional and respectful tone throughout the process can greatly improve your chances of a positive outcome.

Discounts and Savings: A Complete Guide To Car Insurance For Small Business Owners In America

Saving money on your small business car insurance is crucial for your bottom line. Fortunately, many discounts are available to help reduce your premiums. Understanding these discounts and how to qualify for them can significantly impact your overall insurance costs. Let’s explore some common ways to lower your premiums.

Common Car Insurance Discounts for Small Businesses

Several discounts are frequently offered by insurance providers to small business owners. These discounts can substantially reduce your premiums, making insurance more affordable and manageable. Taking advantage of these savings requires understanding the specific requirements for each discount.

- Safe Driving Discounts: Insurance companies reward safe drivers with lower premiums. This typically involves a clean driving record with minimal or no accidents and traffic violations over a specified period (usually 3-5 years). Some companies may offer discounts based on telematics data, which tracks your driving behavior through a device installed in your vehicle.

- Multi-Policy Discounts: Bundling your business auto insurance with other insurance policies, such as commercial property insurance or workers’ compensation, often results in a significant discount. This demonstrates loyalty to the insurer and reduces their administrative costs.

- Business-Specific Discounts: Certain industries or business types may qualify for specific discounts. For example, businesses operating primarily in low-risk areas or those with specific safety measures in place might receive reduced premiums. Some insurers offer discounts for businesses that utilize advanced safety features in their vehicles, such as anti-theft devices or advanced driver-assistance systems (ADAS).

- Vehicle Safety Features Discount: Cars equipped with anti-theft devices, airbags, and other safety features often qualify for discounts. These features reduce the risk of accidents and associated claims, allowing insurers to offer lower premiums.

- Payment Method Discounts: Paying your premium in full upfront, rather than in installments, can sometimes lead to a discount. This is because it simplifies the insurer’s billing and collection processes.

Qualifying for and Maximizing Discounts

To maximize your savings, proactively seek out and qualify for as many discounts as possible. This often involves providing documentation to support your eligibility, such as a clean driving record, proof of other insurance policies, or details about your vehicle’s safety features. It’s crucial to thoroughly review your insurance policy and contact your provider to inquire about available discounts.

List of Potential Discounts and Requirements

The availability of specific discounts varies by insurance provider and state. Always contact your insurer to verify which discounts apply to your situation.

| Discount Type | Requirements | Example |

|---|---|---|

| Safe Driver Discount | Clean driving record (no accidents or tickets in a specified period) | No accidents or moving violations in the past three years. |

| Multi-Policy Discount | Bundling multiple insurance policies with the same insurer (e.g., auto and commercial property) | Bundling business auto insurance with commercial property insurance. |

| Good Student Discount (if applicable) | Maintaining a high GPA for drivers under a certain age. | A college student maintaining a 3.5 GPA or higher. |

| Vehicle Safety Feature Discount | Presence of safety features like anti-theft systems or advanced driver-assistance systems. | Vehicle equipped with anti-lock brakes and airbags. |

| Defensive Driving Course Discount | Completion of an approved defensive driving course. | Completion of a state-approved defensive driving course within the last year. |

State-Specific Regulations

Navigating the world of car insurance for your small business can feel complicated, and understanding state-specific regulations adds another layer. Each state in the US has its own unique set of rules regarding minimum coverage requirements, types of insurance mandated, and how insurers operate. Ignoring these differences can lead to significant legal and financial repercussions. This section will illuminate some key variations you should be aware of.The most significant differences between states lie in their minimum liability coverage requirements.

These requirements dictate the minimum amount of financial protection an insurer must provide if you’re found at fault in an accident. Some states mandate very low minimums, leaving you potentially vulnerable to substantial personal liability if you cause a serious accident. Others have much higher minimums, offering greater protection but often resulting in higher premiums. For example, while some states might require only $10,000 in bodily injury liability coverage per person, others mandate $100,000 or even more.

Similarly, property damage liability limits vary widely.

Minimum Liability Coverage Requirements

Understanding your state’s minimum liability coverage requirements is paramount. Failure to meet these requirements can result in hefty fines and even license suspension. It’s crucial to check your state’s Department of Insurance website for the precise figures. Consider purchasing coverage that exceeds the minimum to safeguard your business from potentially devastating financial losses. This is especially important for businesses that frequently use vehicles for deliveries, client visits, or employee commutes.

Uninsured/Underinsured Motorist Coverage

Many states require or strongly recommend uninsured/underinsured motorist (UM/UIM) coverage. This protects you if you’re involved in an accident caused by a driver without sufficient insurance. The availability and requirements for this coverage vary widely by state. Some states mandate it, while others only make it optional. The coverage limits also differ significantly.

Consider the frequency of driving in your area, the prevalence of uninsured drivers, and the potential financial risk to your business before making a decision on UM/UIM coverage.

State-Specific Endorsements

Certain states may require or strongly recommend specific endorsements, which are additions to your standard policy that provide extra coverage for particular situations. For instance, some states might require endorsements for environmental damage or specific types of cargo. It’s important to research your state’s requirements to ensure your policy adequately protects your business’s unique operations and potential risks. Ignoring these state-specific endorsements could leave significant gaps in your insurance protection.

Insurance for High-Risk Businesses

Securing adequate car insurance for small businesses involved in high-risk activities, such as transportation or delivery services, presents unique challenges. Standard commercial auto policies often fall short of the coverage needed, leaving business owners vulnerable to significant financial losses in the event of an accident. Understanding the nuances of high-risk insurance is crucial for protecting your business and your assets.High-risk businesses often require specialized coverage beyond what’s offered in a standard commercial auto policy.

Standard policies typically cover liability and collision, but may not adequately address the unique exposures faced by businesses engaged in frequent driving, transporting valuable goods, or operating in challenging conditions. Specialized high-risk coverage addresses these gaps by offering higher liability limits, broader coverage for cargo damage, and specific endorsements to address unique circumstances.

Specialized High-Risk Auto Insurance Coverage

Businesses involved in high-risk activities, like courier services or food delivery, should explore options beyond standard commercial auto insurance. These options often include increased liability limits to cover potential damages exceeding those of a standard policy. For instance, a delivery service transporting high-value electronics might need significantly higher liability coverage than a small landscaping company. Additional coverage might include cargo insurance to protect the goods being transported, and even non-owned auto coverage to protect the business if employees use their personal vehicles for work-related purposes.

Umbrella liability policies can also provide an extra layer of protection against significant claims exceeding the limits of the primary policy.

Comparing Standard and High-Risk Policies

A standard commercial auto policy typically provides basic liability and collision coverage. Liability coverage protects against claims from third parties injured or whose property is damaged in an accident. Collision coverage pays for repairs to your vehicle regardless of fault. High-risk policies, however, often feature significantly higher liability limits, coverage for cargo loss or damage, and potentially coverage for accidents involving uninsured or underinsured motorists.

The premiums for high-risk policies will naturally be higher to reflect the increased risk. For example, a standard policy for a small bakery might cost a few hundred dollars a year, while a similar policy for a trucking company hauling hazardous materials could cost several thousand.

Risk Mitigation Strategies for Affordable Insurance

Several strategies can help high-risk businesses mitigate their risk and secure more affordable insurance. Implementing robust driver training programs, including defensive driving courses, can demonstrate a commitment to safety and potentially reduce premiums. Investing in vehicle maintenance and regularly inspecting vehicles to ensure they are roadworthy is also crucial. Accurate record-keeping, including meticulous documentation of driving records and accident reports, helps insurers assess risk accurately.

Furthermore, maintaining a clean driving record and employing experienced, qualified drivers are essential for securing favorable rates. Finally, shopping around and comparing quotes from multiple insurers is vital to finding the best coverage at the most competitive price.

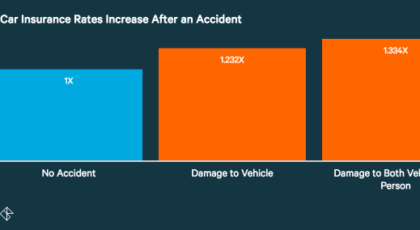

Impact of Driving Records

Your business’s driving record significantly impacts your car insurance premiums. Insurance companies assess risk based on the driving history of the drivers associated with your business policies. A clean record generally translates to lower premiums, while accidents, traffic violations, and other incidents can lead to substantial increases. This is because a history of at-fault accidents indicates a higher likelihood of future claims, increasing the insurer’s financial risk.Insurance companies use a points system to evaluate driving records.

Each violation or accident earns points, raising your risk profile and leading to higher premiums. The severity of the violation influences the number of points assigned; a speeding ticket might result in fewer points than a DUI conviction or a serious accident. These points typically remain on your record for a specific period, usually three to five years, impacting your rates for that duration.

The impact of these points varies by insurer and state.

Appealing a Rate Increase Based on Driving Record

If you believe a rate increase based on your driving record is unjustified, you have the right to appeal. This process usually involves contacting your insurance company directly and presenting your case. You’ll need to gather supporting documentation, such as police reports or court records that might offer a different perspective on the incident(s) leading to the increased premiums. Clearly explaining mitigating circumstances or demonstrating improvements in driving behavior can strengthen your appeal.

Insurance companies have internal review processes, and appealing might lead to a reconsideration of your rate. However, success isn’t guaranteed; the decision ultimately rests with the insurance company.

Maintaining a Clean Driving Record

Maintaining a clean driving record is crucial for securing favorable car insurance rates. Several proactive measures can significantly reduce the likelihood of accidents and violations. These include defensive driving training courses, which help drivers develop safer driving habits and can even lead to insurance discounts. Regular vehicle maintenance is also important; ensuring your car is in good working order reduces the risk of mechanical failures that could cause accidents.

Careful adherence to traffic laws, including speed limits and safe following distances, is paramount. Always wear seatbelts, and avoid driving while distracted or impaired. By consistently practicing safe driving habits, you can minimize the risk of incidents that could negatively impact your insurance premiums.

Working with Insurance Brokers

Source: skillsandtech.com

Navigating the world of small business car insurance can be complex, and leveraging the expertise of an independent insurance broker can significantly simplify the process and potentially save you money. Brokers act as intermediaries, connecting you with multiple insurance companies to find the best coverage at the most competitive price. This contrasts sharply with dealing directly with individual insurers, where your options are limited to that single company’s offerings.Independent insurance brokers offer several key advantages over dealing directly with insurance companies.

They provide an unbiased perspective, allowing you to compare a wide range of policies from different insurers, ensuring you get the best fit for your business needs and budget. This unbiased approach is crucial, as insurance companies naturally prioritize their own products.

A Complete Guide to Car Insurance for Small Business Owners in America covers a lot of ground, from liability to commercial auto policies. Understanding the specific needs of your business is key, but it’s also helpful to consider other factors, like how insurance costs differ for various drivers. For example, if you’re hiring new drivers, check out this resource on Understanding the Costs of Car Insurance for New Drivers in the United States to better manage your overall insurance budget.

This knowledge will help you make informed decisions when building your comprehensive small business insurance plan.

Broker Services

Insurance brokers provide a comprehensive suite of services designed to streamline the car insurance process for small business owners. These services typically include:

Beyond simply finding you a policy, brokers actively work to secure the most favorable rates. They understand the intricacies of insurance policies and can help you decipher complex terms and conditions, ensuring you have the right coverage without overpaying. They also handle all the paperwork and communication with insurance companies, freeing up your valuable time to focus on running your business.

Broker vs. Direct Insurance Company

The key difference lies in the breadth of options and the level of personalized service. Dealing directly with an insurance company limits you to their specific products and pricing. A broker, on the other hand, acts as your advocate, shopping around for the best deal from multiple insurers, often accessing options unavailable to individuals. This comparison is akin to shopping for a car at a single dealership versus visiting multiple dealerships to compare models and prices.

The broker approach provides a wider selection and increased negotiating power.

Choosing a Broker

Selecting the right broker is vital. Look for a broker with experience in insuring small businesses, a strong reputation, and a commitment to customer service. Check online reviews and seek recommendations from other business owners. A good broker will take the time to understand your specific needs and risk profile before recommending any policy. Don’t hesitate to interview several brokers before making a decision.

Consider asking about their commission structure to understand any potential conflicts of interest, though reputable brokers prioritize finding the best policy for their clients, regardless of commission.

Future Trends in Small Business Car Insurance

The car insurance landscape is constantly evolving, driven by technological advancements and shifting societal norms. These changes present both challenges and opportunities for small business owners who rely on vehicles for operations. Understanding these emerging trends is crucial for effectively managing insurance costs and ensuring adequate coverage.The increasing integration of technology is reshaping how car insurance is priced and provided.

This shift impacts how small businesses acquire and manage their policies, potentially altering their overall insurance costs and coverage options.

Telematics and Usage-Based Insurance

Telematics uses technology like GPS tracking and smartphone apps to monitor driving behavior. This data allows insurers to offer usage-based insurance (UBI) programs, where premiums are based on actual driving habits rather than broad demographic categories. For example, a small business with drivers who consistently demonstrate safe driving practices—maintaining steady speeds, avoiding harsh braking and acceleration, and driving primarily during off-peak hours—could qualify for significantly lower premiums through a UBI program.

Conversely, businesses with drivers exhibiting risky behaviors might see higher premiums. This system incentivizes safer driving and offers a more personalized and potentially cost-effective insurance solution. The widespread adoption of telematics is expected to continue, leading to more refined risk assessment and potentially lower premiums for responsible drivers.

Artificial Intelligence and Automated Claims Processing

Artificial intelligence (AI) is rapidly transforming the claims process. AI-powered systems can analyze accident data, assess damage, and expedite claims settlements, leading to faster reimbursements for small businesses. For instance, AI can quickly assess the damage to a delivery van involved in a minor collision, allowing for a faster repair and return to service, minimizing business disruption. This automated approach also helps reduce the administrative burden on both insurers and businesses, streamlining the entire claims process.

Running a small business requires careful financial planning, and that includes comprehensive car insurance. Understanding your coverage needs is crucial, and this guide will help you navigate the complexities. For those with young drivers in the family, managing their insurance costs can also be a challenge; check out this helpful resource on How to Save on Car Insurance for Teens and Young Adults in the U.S.

for some smart tips. Returning to business insurance, remember to factor in all company vehicles and drivers for complete protection.

However, the reliance on AI also necessitates careful consideration of data privacy and security.

Increased Focus on Sustainability and Green Initiatives

Growing environmental concerns are pushing insurers to incentivize eco-friendly driving practices. We are seeing the emergence of insurance programs that reward drivers who use electric or hybrid vehicles, maintain consistent vehicle maintenance, or demonstrate fuel-efficient driving habits. A small business operating a fleet of electric delivery trucks could potentially benefit from substantial premium discounts reflecting their commitment to sustainability.

This trend aligns with broader societal shifts toward environmental responsibility and may become a significant factor in shaping future insurance policies.

The Rise of Insurtech Companies

The emergence of Insurtech companies—insurance companies utilizing technology—is disrupting the traditional insurance model. These companies often offer more flexible and customer-centric policies, leveraging technology to personalize insurance options and streamline the purchasing process. Small businesses can expect more choices and potentially more competitive pricing as Insurtech companies expand their market share. The increased competition could lead to innovative product offerings and better customer service.

Ending Remarks

Securing the right car insurance for your small business is a critical investment, not just an expense. By understanding the various coverage options, assessing your risks accurately, and diligently comparing policies, you can protect your assets, your employees, and the future of your business. Remember, proactive planning and informed choices are key to navigating the complexities of commercial auto insurance and achieving peace of mind.

This complete guide has equipped you with the essential knowledge to confidently manage your business’s car insurance needs. Now, go forth and protect your enterprise!

FAQ

What happens if my employee causes an accident while driving a company vehicle?

Your business’s insurance policy should cover accidents caused by your employees while they’re on company business. However, the specifics depend on your policy and the circumstances of the accident. Always report accidents to your insurer promptly.

Can I get car insurance for a leased company vehicle?

Yes, you can absolutely get car insurance for a leased company vehicle. You’ll likely need to provide the leasing company with proof of insurance. Contact your insurance provider to discuss coverage options for leased vehicles.

How often should I review my car insurance policy?

It’s a good idea to review your car insurance policy at least annually, or whenever there’s a significant change in your business operations (e.g., new hires, new vehicles, expansion into a new area). This allows you to ensure your coverage still meets your needs.