How to Get the Best Car Insurance Rates After an Accident in the U.S.

How to Get the Best Car Insurance Rates After an Accident in the U.S. is a question many drivers face. A car accident can be a stressful experience, made even worse by the potential impact on your insurance premiums. This guide navigates the complexities of post-accident insurance, offering practical strategies to minimize rate increases and secure the best possible coverage.

We’ll explore everything from reporting the accident to negotiating with your insurer and improving your driving record to secure more favorable rates.

Understanding how insurance companies assess risk after an accident is crucial. Factors like the severity of the accident, who was at fault, and your driving history all play a significant role in determining your future premiums. By understanding these factors and employing the strategies Artikeld here, you can significantly improve your chances of obtaining competitive rates even after an accident.

Table of Contents

ToggleUnderstanding Your Post-Accident Situation

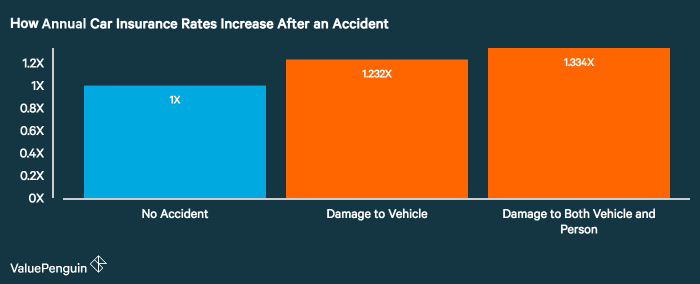

Getting into a car accident is stressful, and dealing with the aftermath can feel overwhelming. One significant consequence you’ll likely face is an increase in your car insurance premiums. Understanding how this happens and what you can do to mitigate the impact is crucial.Your insurance rates will almost certainly increase after an accident, regardless of fault. Insurance companies view accidents as indicators of increased risk.

The severity of the accident and your level of responsibility directly influence the extent of the premium increase. Even if you weren’t at fault, your insurer might still raise your rates, as they’ll factor in the increased probability of future claims.

Factors Influencing Rate Increases After an Accident, How to Get the Best Car Insurance Rates After an Accident in the U.S.

Several factors determine how much your insurance rates will increase after an accident. These include the severity of the accident (property damage, injuries, fatalities), who was at fault, your driving record prior to the accident, your insurance history (claims made, lapse in coverage), your location (accident location and state-specific regulations), and the type of vehicle you drive. For example, a minor fender bender with no injuries might result in a smaller rate increase than a serious accident involving multiple vehicles and injuries.

Similarly, a driver with a clean driving record might experience a less significant increase than a driver with multiple prior accidents or violations.

Reporting an Accident to Your Insurer

Prompt and accurate reporting of the accident is critical. Follow these steps:

- Check for Injuries: Ensure the safety of yourself and others involved. Call emergency services if necessary.

- Gather Information: Collect the names, contact information, driver’s license numbers, insurance details, and license plate numbers of all drivers involved. Note down the location of the accident, date, and time.

- Document the Scene: Take photos and videos of the damage to all vehicles involved, the accident scene, and any visible injuries. Note the weather conditions and any visible road hazards.

- Contact Your Insurer: Report the accident to your insurance company as soon as possible, usually within 24-48 hours. Provide them with all the information you’ve gathered. Be prepared to provide a detailed account of the events leading up to and during the accident.

- File a Police Report: If the accident involved injuries or significant property damage, file a police report. Obtain a copy of the report for your records and provide it to your insurer.

- Cooperate with Investigations: Fully cooperate with your insurer’s investigation. Provide truthful and accurate information to avoid any delays or complications.

Following these steps will help ensure a smooth claims process and potentially minimize the impact on your insurance rates. Remember, honesty and prompt action are key. Failing to report the accident promptly or providing false information can lead to more significant consequences.

Finding the Right Insurance Provider

Source: peakd.com

Getting the best car insurance rates after an accident can be tough, but it’s manageable. Factors like your driving record and the accident details heavily influence premiums. However, understanding how rates work for different demographics is key; for example, check out Top Tips for Finding Affordable Car Insurance for Senior Drivers in the U.S. for insights into age-related factors.

Then, armed with this knowledge, you can better negotiate rates and find the best coverage after your accident.

After an accident, finding the right insurance provider can significantly impact your claim process and overall experience. Choosing wisely means comparing policies, understanding coverage options, and selecting a company known for its responsiveness and fairness. This section will guide you through the process of finding the best fit for your needs.

Insurance companies vary greatly in how they handle post-accident claims. Some are known for their swift and efficient processing, while others may be more bureaucratic and slow. Understanding these differences is crucial to making an informed decision. Policy details, such as the claims process, the types of coverage offered, and the company’s reputation for customer service, all play a significant role in determining which provider is best suited for you.

Key Features of a Post-Accident Insurance Policy

Finding the right policy involves examining specific features crucial for a smooth claims experience. These features often differentiate one provider from another and can significantly impact the outcome of your claim.

When comparing policies, prioritize those with clear and comprehensive coverage for liability, medical payments, uninsured/underinsured motorist protection, and collision/comprehensive coverage. Consider the policy’s deductible amount – a higher deductible generally means lower premiums, but it also means you’ll pay more out-of-pocket in the event of a claim. Look for policies with readily available customer service channels, such as 24/7 phone support and online claim portals, to ensure you can easily reach assistance when needed.

Finally, review customer reviews and ratings from independent sources to gain insight into a company’s track record of handling post-accident claims fairly and efficiently.

Examples of Companies with Effective Post-Accident Claim Handling

While specific performance varies by location and individual circumstances, several insurance companies have generally positive reputations for their post-accident claim handling. It is important to note that these are examples and not an exhaustive list, and individual experiences may vary.

Companies like USAA, often cited for their excellent customer service and quick claim processing, particularly for their military members and their families, frequently receive high marks from customers. Other large national insurers, such as State Farm and Geico, also have extensive networks and resources to handle a high volume of claims. However, it’s crucial to remember that the quality of service can depend on various factors, including the specific claims adjuster assigned to your case and the complexity of the claim itself.

Therefore, researching individual experiences through customer reviews remains a valuable step in your decision-making process.

Strategies for Lowering Your Rates

After an accident, your car insurance rates will likely increase. However, there are several proactive steps you can take to mitigate the impact and potentially lower your premiums over time. By understanding these strategies and implementing them effectively, you can regain control of your insurance costs and minimize the financial burden.

Defensive Driving Courses

Completing a state-approved defensive driving course can significantly reduce your insurance premiums. Many insurance companies offer discounts to drivers who demonstrate a commitment to safe driving practices. These courses typically cover topics such as hazard perception, safe following distances, and collision avoidance techniques. Successfully completing the course provides proof of your dedication to safer driving, which insurers view favorably.

The discount amount varies depending on the insurer and your location, but it can often be substantial, sometimes exceeding 10% of your annual premium. For example, a driver paying $1200 annually could save $120 or more.

Bundling Insurance Policies

Bundling your home and auto insurance policies with the same provider is another effective way to lower your overall insurance costs. Insurance companies often offer significant discounts for bundling, as it simplifies their administration and reduces the risk of losing a customer. The discount percentage varies by insurer but can range from 5% to 25% or more. Imagine a scenario where your annual auto insurance is $1000 and your home insurance is $800.

A 10% bundle discount could save you $180 annually.

Insurance Discounts

Several types of discounts are available from various insurers. The specific discounts and eligibility criteria differ widely. The following table provides a comparison of common discounts:

| Insurer | Discount Type | Discount Percentage | Eligibility Criteria |

|---|---|---|---|

| Progressive | Safe Driver Discount | Up to 30% | Clean driving record for a specified period (varies by state) |

| State Farm | Bundling Discount | Up to 17% | Having both home and auto insurance with State Farm |

| Geico | Good Student Discount | Up to 15% | Maintaining a B average or higher in school |

| Allstate | Multi-Car Discount | Up to 10% per vehicle | Insuring multiple vehicles under the same policy |

Negotiating with Your Insurer

After an accident, your insurance rates might increase. However, you don’t have to passively accept this. Negotiating with your insurer can potentially lead to lower premiums than initially offered. Effective communication and preparation are key to a successful negotiation.Negotiating effectively requires a calm and professional approach. Avoid emotional outbursts or aggressive language; instead, focus on presenting your case clearly and concisely.

Remember, your insurer is a business, and they’re more likely to work with you if you demonstrate a reasonable and understanding attitude. Documenting everything, from the accident itself to your communication with the insurer, is crucial.

Effective Communication Strategies

Effective communication involves clearly articulating your situation, demonstrating your understanding of their concerns, and proposing solutions. For instance, if your rates increased due to an at-fault accident, you could explain any mitigating circumstances, such as poor road conditions or another driver’s negligence. You might also highlight your clean driving record before the accident, emphasizing your commitment to safe driving.

A well-structured letter outlining these points can be more persuasive than a phone call. Consider using phrases like, “I understand your concerns regarding the accident, however…” to acknowledge their perspective before presenting your arguments.

Gathering and Presenting Supporting Documentation

Strong documentation strengthens your negotiation position. This includes the police report (if applicable), photos of the accident scene, repair estimates, and any medical records related to injuries sustained. If another driver was at fault, include their insurance information and any evidence supporting their liability. Organize these documents clearly and chronologically; a well-organized binder or a clearly labeled digital folder will demonstrate your preparedness and professionalism.

Present this documentation as evidence supporting your claim for a lower rate increase.

Appealing a Rate Increase Decision

If your initial negotiation fails, you can formally appeal the rate increase decision. Most insurers have a formal appeals process Artikeld in their policy documents. Your appeal should reiterate your arguments from the initial negotiation, including any new evidence you’ve gathered. Clearly state the reasons why you believe the rate increase is unfair or excessive, and cite specific clauses in your policy or relevant state laws if applicable.

Keep records of all correspondence and interactions throughout the appeal process. Be persistent and professional, remembering that persistence can often yield positive results. Consider seeking legal advice if your appeal is unsuccessful and you believe the rate increase is unjustified.

Exploring Different Coverage Options

After an accident, reviewing your car insurance coverage is crucial. Understanding the different types of coverage and their impact on your premiums can significantly influence your post-accident financial situation and future rates. This section will help you navigate the complexities of liability, uninsured/underinsured motorist, collision, and comprehensive coverage options.

Liability Coverage Options After an Accident

Liability coverage pays for damages and injuries you cause to others in an accident. The amount of liability coverage you carry is typically expressed as two numbers, such as 25/50/25. This means $25,000 per person for bodily injury, $50,000 total for bodily injury per accident, and $25,000 for property damage. After an accident, your insurer will assess the damages and pay claims up to your policy limits.

If the damages exceed your coverage, you’ll be personally responsible for the difference. Increasing your liability limits can protect you from significant financial losses, though it will likely increase your premiums. Consider the potential costs of serious injuries or extensive property damage when choosing your liability limits. A higher limit provides a greater safety net, but comes with a higher premium.

It’s wise to consult with an insurance professional to determine the appropriate level of liability coverage based on your individual risk profile and financial situation.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. This is vital because many drivers operate without sufficient insurance. UM coverage protects you and your passengers for medical bills and vehicle repairs if the at-fault driver lacks adequate coverage or no coverage at all. UIM coverage steps in if the other driver’s liability coverage is insufficient to cover your damages.

For example, if you’re injured in an accident caused by an underinsured driver whose policy only covers $25,000 in damages, but your medical bills total $50,000, your UIM coverage would help pay the remaining $25,000. This type of coverage is highly recommended, as it provides a critical safety net in situations where the at-fault driver cannot fully compensate you for your losses.

Getting the best car insurance rates after an accident involves careful comparison shopping and demonstrating responsible driving. This often includes showing a clean driving record since the accident, which is why understanding how to manage your premiums is key. For instance, check out this guide on How to Lower Your Car Insurance Premiums After a Traffic Violation in the U.S.

to learn how to avoid future rate increases. By proactively addressing past driving issues, you’ll significantly improve your chances of securing better rates in the future.

The cost of adding UM/UIM coverage is relatively low compared to the potential financial protection it provides.

Collision and Comprehensive Coverage Implications on Premiums

Collision coverage pays for damage to your vehicle caused by an accident, regardless of fault. Comprehensive coverage protects against damage caused by events other than collisions, such as theft, vandalism, fire, or hail. Both collision and comprehensive coverage will increase your premiums. After an accident, the extent to which these coverages impact your future rates depends on several factors, including the severity of the accident, your claim history, and your insurance company’s policies.

If you file a collision claim, expect a premium increase. Similarly, a comprehensive claim might also result in a rate hike. However, the increase might be less significant than that for a collision claim. Weighing the cost of these coverages against the potential for future repairs or replacement costs is a crucial decision. For older vehicles with lower values, dropping collision and comprehensive might be a cost-effective strategy, while newer, more expensive vehicles often warrant retaining these coverages.

Improving Your Driving Record

A clean driving record is a significant factor in determining your car insurance rates. Insurance companies view drivers with a history of accidents and violations as higher risks, leading to increased premiums. Conversely, maintaining a spotless record demonstrates responsible driving habits and can result in substantial savings on your insurance costs. The impact of a clean record can be substantial, potentially saving you hundreds or even thousands of dollars annually.Your driving record, officially known as your motor vehicle report (MVR), is a comprehensive summary of your driving history, including accidents, speeding tickets, and other infractions.

Insurance companies access this record to assess your risk profile. A history of multiple incidents will significantly raise your premiums, while a clean record signals to insurers that you’re a low-risk driver, justifying lower rates.

Removing Minor Infractions from Your Driving Record

Depending on your state and the specific infraction, some minor traffic violations might be eligible for dismissal or removal from your driving record after a certain period. This process often involves completing traffic school or demonstrating a period of safe driving. For instance, some states allow for the dismissal of a single speeding ticket if you haven’t had any other violations within a specific timeframe.

However, more serious offenses like DUIs or reckless driving are typically not eligible for removal. To determine the eligibility of your specific infractions for removal, you should consult your state’s Department of Motor Vehicles (DMV) website or contact them directly. They can provide specific information about your record and the procedures for potential removal of eligible violations.

Maintaining a Safe Driving Record

Maintaining a clean driving record requires consistent responsible driving behavior. This involves adhering to traffic laws, practicing defensive driving techniques, and ensuring your vehicle is in good working order. Defensive driving involves anticipating potential hazards and reacting proactively to prevent accidents. This includes maintaining a safe following distance, avoiding distractions like cell phones, and being aware of your surroundings.

Getting the best car insurance rates after an accident in the U.S. involves shopping around and comparing quotes. A key factor to consider is the value of additional coverage; for instance, check out this article on whether Is It Worth Paying for Roadside Assistance Coverage in Your Car Insurance? to potentially lower your premiums in the long run.

Ultimately, securing the best rate depends on your individual needs and driving history.

Regular vehicle maintenance, including tire checks and brake inspections, contributes to safer driving conditions and helps prevent accidents caused by mechanical failures. By consistently practicing safe driving habits and avoiding risky behaviors, you significantly reduce the likelihood of accidents and traffic violations, ultimately leading to lower insurance premiums and a cleaner driving record.

The Role of Credit Score: How To Get The Best Car Insurance Rates After An Accident In The U.S.

Source: cloudinary.com

Your credit score plays a surprisingly significant role in determining your car insurance rates. Many insurance companies use your credit history as a factor in assessing your risk profile, believing that individuals with poor credit are more likely to file claims. This isn’t necessarily about driving ability, but rather reflects a broader assessment of financial responsibility.Insurance companies utilize complex algorithms that consider various credit-related factors to calculate your insurance premium.

While the exact formula varies between insurers, a lower credit score generally translates to higher premiums, while a higher credit score often leads to lower premiums. This practice is legal in most states, though some states have banned or restricted its use. It’s important to note that this is a controversial practice, with some arguing that it unfairly penalizes individuals with lower credit scores who may be excellent drivers.

Credit Score’s Impact on Insurance Quotes

The impact of your credit score on your car insurance quote can be substantial. For example, a person with a poor credit score (below 600) might pay significantly more for the same coverage than someone with an excellent credit score (750 or above). The difference can range from a few hundred dollars annually to even thousands, depending on the insurer, the coverage level, and other factors.

Imagine two identical drivers with the same driving history and vehicle, but one with a 620 credit score and the other with a 780 credit score. The driver with the higher credit score could potentially save hundreds of dollars per year simply because of their better credit history. This underscores the importance of maintaining a good credit score to save money on insurance.

Strategies for Improving Credit Score

Improving your credit score takes time and consistent effort, but the potential savings on car insurance, and other financial benefits, are substantial.Improving your credit score involves several key strategies:

- Pay Bills on Time: This is the single most important factor affecting your credit score. Consistent on-time payments demonstrate financial responsibility. Even a single late payment can negatively impact your score.

- Keep Credit Utilization Low: Your credit utilization ratio (the amount of credit you’re using compared to your total available credit) is a crucial factor. Aim to keep your utilization below 30% for optimal credit health.

- Maintain a Mix of Credit Accounts: Having a variety of credit accounts (credit cards, loans, etc.) in good standing can demonstrate responsible credit management. However, avoid opening too many new accounts in a short period.

- Address Negative Items on Your Credit Report: Review your credit report regularly and dispute any inaccuracies or errors. Negative items like collections or bankruptcies can significantly lower your score. Addressing these issues can help improve your score over time.

- Monitor Your Credit Score Regularly: Track your credit score using free services or credit monitoring tools to monitor your progress and identify any potential issues.

By consistently implementing these strategies, you can significantly improve your credit score over time, leading to potentially lower car insurance premiums. Remember that improving your credit score is a long-term process, and results won’t be immediate. Patience and persistence are key.

Getting the best car insurance rates after an accident can be tough, but there are strategies to lower your premiums. Understanding your options is key, and this is especially true for young drivers, who often face higher rates. For advice on finding affordable coverage as a young driver, check out this helpful guide: How to Find the Most Affordable Car Insurance for Young Drivers in the U.S.

Then, once you’ve got a handle on the basics, you can better navigate the process of finding the best rates after an accident, focusing on factors like improving your driving record and comparing quotes from multiple insurers.

Understanding Claims Processes

Navigating the insurance claims process after a car accident can feel overwhelming, but understanding the steps involved can significantly ease the stress and improve your chances of a successful claim. This section Artikels the process, emphasizes the importance of timely reporting, and addresses common reasons for claim denials.Filing a claim promptly and accurately is crucial for a smooth process.

Delays can lead to complications and potential denial of your claim. The steps involved generally include reporting the accident to your insurer, gathering necessary documentation, and cooperating fully with the investigation.

Accident Reporting and Initial Claim Filing

Immediately after an accident, contact your insurance company to report the incident. Provide accurate details including the date, time, location, and circumstances of the accident. Note the names and contact information of all involved parties and any witnesses. If possible, take photos of the damage to your vehicle and the accident scene. Your insurance company will then guide you through the next steps, which typically involve filing a formal claim.

This often involves completing a claim form providing comprehensive details of the accident and the resulting damages. Failure to report the accident promptly, or providing inaccurate information, can jeopardize your claim.

Documentation and Evidence Gathering

Thorough documentation is essential for a successful claim. This includes the police report (if one was filed), photos and videos of the accident scene and vehicle damage, medical records documenting injuries, repair estimates, and receipts for any related expenses. The more comprehensive your documentation, the stronger your case will be. Keep copies of all documents for your records. Consider using a digital system for organization to easily access and share documents with your insurer.

Claim Investigation and Evaluation

Once you file your claim, the insurance company will launch an investigation to determine liability and the extent of damages. This may involve reviewing your police report, witness statements, and medical records. They will also assess the damage to your vehicle and evaluate the reasonableness of your repair estimates. Cooperate fully with the investigation and respond promptly to any requests for information.

Failure to cooperate can result in delays or denial of your claim.

Common Claim Denial Reasons and Solutions

Claims can be denied for various reasons. Some common reasons include: failure to report the accident promptly, providing inaccurate or misleading information, lack of sufficient evidence, exceeding policy limits, pre-existing damage, or not meeting the policy’s terms and conditions. If your claim is denied, review the denial letter carefully to understand the reasons. Gather additional evidence to address any concerns raised by the insurer.

Consider appealing the decision and presenting a compelling case with all supporting documentation. In some cases, seeking legal counsel may be beneficial. For example, if a claim is denied due to a pre-existing condition, providing clear documentation showing the damage was not pre-existing, such as a recent vehicle inspection report, might be effective. If the denial is based on a policy exclusion, a lawyer might help you understand the policy’s nuances and explore possible solutions.

Getting the best car insurance rates after an accident can be tricky, but understanding your coverage is key. To find the best deals, you’ll need to know the difference between your options; check out this helpful guide on What’s the Difference Between Full Coverage and Liability Insurance in the U.S.? to make informed decisions. Then, shop around and compare quotes from multiple insurers to secure the most affordable rates.

Long-Term Strategies for Insurance Savings

Securing affordable car insurance isn’t just about navigating the aftermath of an accident; it’s about building a long-term strategy for maintaining lower rates. By proactively managing your risk and driving record, you can significantly reduce your premiums over time. These strategies, when implemented consistently, can lead to substantial savings over the years.

Implementing a long-term strategy requires consistent effort and mindful choices. The rewards, however, are well worth the investment, translating into significant savings on your car insurance premiums year after year.

Maintaining a Clean Driving Record

A clean driving record is the cornerstone of low insurance premiums. Every accident, speeding ticket, or moving violation increases your risk profile, leading to higher premiums. Conversely, maintaining a spotless record signals to insurers that you’re a low-risk driver, resulting in significant discounts. Companies often offer safe-driver discounts that can be substantial. For instance, a driver with a five-year clean record might receive a 20-30% discount compared to a driver with multiple incidents.

This discount compounds over time, leading to considerable long-term savings.

Choosing the Right Car

The type of car you drive significantly impacts your insurance rates. Insurers consider factors like the car’s safety features, repair costs, and theft risk. Vehicles with high safety ratings and lower repair costs tend to have lower insurance premiums. For example, a small, fuel-efficient car with advanced safety features will likely have lower insurance than a high-performance sports car with a history of theft.

This is a one-time decision with lasting impact on your insurance costs.

Bundling Insurance Policies

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, often leads to significant discounts. Many insurers offer discounts for bundling policies, recognizing the reduced administrative costs and increased customer loyalty. A typical bundled discount could range from 10% to 25% depending on the insurer and the specific policies bundled. This strategy offers immediate and ongoing savings.

Increasing Your Deductible

While increasing your deductible means you’ll pay more out-of-pocket in the event of a claim, it also lowers your premium. This is because you are accepting more financial responsibility. Carefully consider your financial situation and risk tolerance before increasing your deductible. A higher deductible, while requiring a larger upfront payment in case of an accident, can result in significant long-term premium reductions.

For example, increasing your deductible from $500 to $1000 might lower your premium by 15-20%.

Taking Advantage of Discounts

Insurers frequently offer various discounts, such as those for good students, mature drivers, and those who complete defensive driving courses. Actively seeking and utilizing these discounts can significantly reduce your premium. These discounts can range from 5% to 25% depending on the specific discount and insurer. Regularly review your policy and inquire about available discounts.

Consistent Safe Driving

The impact of consistent safe driving on future insurance costs is undeniable. Maintaining a clean driving record over several years demonstrates responsible driving habits, leading to lower premiums and potential discounts. This isn’t a one-time action but rather a sustained effort that yields substantial long-term rewards. Insurers often reward long-term safe driving with lower rates and even loyalty discounts.

Last Word

Successfully navigating the aftermath of a car accident and securing favorable insurance rates requires proactive planning and a strategic approach. By carefully considering your coverage options, improving your driving record, and effectively communicating with your insurer, you can mitigate the impact of an accident on your premiums. Remember, consistent safe driving and responsible financial habits are key to maintaining affordable car insurance in the long run.

Don’t hesitate to shop around and compare quotes – finding the right insurer is a crucial step in protecting your financial well-being.

Helpful Answers

What if my accident wasn’t my fault?

Even if you weren’t at fault, your rates might still increase. However, providing documentation proving your innocence can help mitigate the increase.

How long does an accident stay on my record?

This varies by state and insurer, but generally, accidents remain on your record for three to five years.

Can I switch insurance companies after an accident?

Yes, you can. Shopping around for a new insurer after an accident is a smart move, as different companies have varying policies and rate structures.

What is the best way to communicate with my insurance company after an accident?

Keep your communication professional and factual. Document everything, and be sure to follow their claims process diligently.