Why Should You Consider Pay-Per-Mile Car Insurance in the U.S.?

Why Should You Consider Pay-Per-Mile Car Insurance in the U.S.? In a world obsessed with optimizing everything, it’s no surprise that car insurance is getting a makeover. Pay-per-mile insurance offers a fresh approach, promising significant savings for those who don’t rack up the miles. But is it right for you? Let’s dive into the details to find out if this innovative insurance model could be the perfect fit for your driving habits and budget.

This new type of car insurance allows you to pay only for the miles you drive, unlike traditional policies that charge a fixed annual premium regardless of mileage. This means that if you’re a low-mileage driver, you could potentially save a significant amount of money on your car insurance premiums. We’ll explore the cost savings, flexibility, environmental benefits, and technological advancements behind this increasingly popular option, while also addressing potential concerns like data privacy.

Table of Contents

ToggleCost Savings Potential

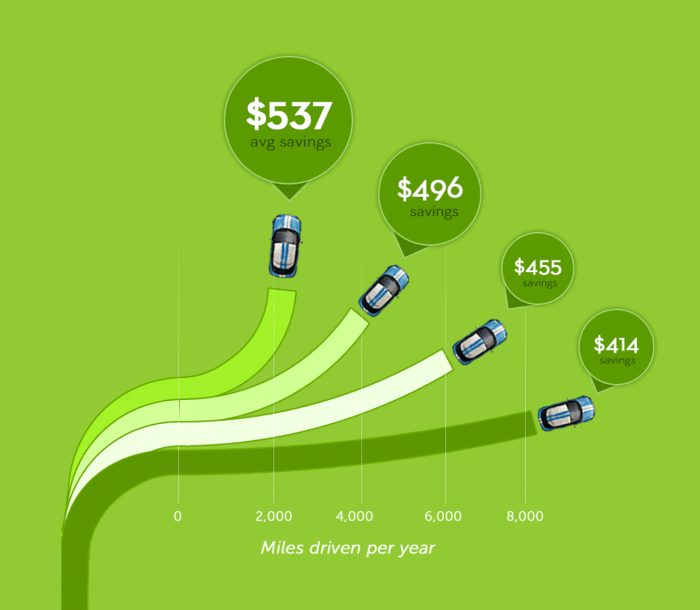

Pay-per-mile car insurance, also known as usage-based insurance, offers a compelling alternative to traditional car insurance policies, particularly for drivers who don’t rack up many miles annually. The core principle is simple: you pay only for the miles you drive, leading to potential significant savings compared to traditional policies that charge a fixed annual premium regardless of driving habits.The primary advantage of pay-per-mile insurance lies in its ability to tailor premiums to individual driving behavior.

Low-mileage drivers, such as retirees, individuals who work from home, or those who rely heavily on public transportation, can significantly reduce their insurance costs. Instead of paying a premium based on an average annual mileage, often higher than their actual usage, they pay a lower base rate plus a per-mile charge, resulting in a lower overall cost.

Cost Comparison Scenarios

Let’s consider a few scenarios to illustrate the cost-effectiveness of pay-per-mile insurance. Imagine two drivers: Sarah, a retiree who drives 5,000 miles a year, and Mark, a commuter who drives 15,000 miles annually. If Sarah opts for traditional insurance with an average annual premium of $1,200, her cost per mile is $0.24. However, with a pay-per-mile plan featuring a base rate of $300 and a per-mile cost of $0.10, her total annual premium would be $800, representing a considerable saving of $400.

Conversely, Mark might find traditional insurance more economical. If his traditional premium is $1,800, his cost per mile is $0.12. A pay-per-mile plan with the same base rate and per-mile cost would cost him $1,800, offering no advantage. This highlights that pay-per-mile insurance is most beneficial for low-mileage drivers.

Average Annual Cost Comparison

A hypothetical comparison of average annual costs for different driving habits can further illuminate the potential savings. These figures are illustrative and will vary depending on the insurer, location, and specific policy details. However, they represent a realistic picture of potential cost differences.

| Annual Mileage | Traditional Insurance (Estimated) | Pay-Per-Mile Insurance (Estimated) |

|---|---|---|

| 5,000 | $1,200 | $800 |

| 10,000 | $1,500 | $1,300 |

| 15,000 | $1,800 | $1,800 |

| 20,000 | $2,100 | $2,300 |

Note that these are estimated figures and actual costs will vary. It is crucial to obtain quotes from multiple insurers to determine the best option based on your individual circumstances. Factors such as driving history, vehicle type, and location also significantly influence premium costs.

Flexibility and Control

Pay-per-mile car insurance offers a level of flexibility and control over your insurance premiums that traditional policies simply can’t match. Instead of paying a fixed annual rate based on broad risk assessments, you pay only for the miles you drive. This directly links your cost to your behavior, empowering you to manage your expenses more effectively.This direct correlation between driving habits and insurance costs incentivizes mindful driving and careful consideration of travel plans.

The more you drive, the more you pay; the less you drive, the less you pay. This simple principle allows for significant personalization and empowers drivers to actively reduce their insurance burden.

Strategies for Minimizing Driving Distance

Reducing your annual mileage can lead to substantial savings with pay-per-mile insurance. Several strategies can help achieve this goal. Careful planning of errands to combine multiple trips into one, utilizing public transportation or ride-sharing services for shorter journeys, and working from home when possible are all effective ways to minimize driving. For example, someone who regularly commutes 20 miles each way to work could potentially save significantly by carpooling, cycling, or working remotely even a few days a week.

Similarly, consolidating shopping trips or opting for grocery delivery services can add up to considerable reductions in overall mileage over time.

Adaptability to Changing Lifestyles

Pay-per-mile insurance adapts remarkably well to changing lifestyles and driving needs. Life events such as retirement, a new job with a shorter commute, or a change in family circumstances often significantly alter driving habits. Traditional insurance policies may not reflect these shifts immediately, potentially leading to overpayment. However, with pay-per-mile insurance, your premiums automatically adjust to reflect your actual driving patterns.

For instance, a recent retiree who drastically reduces their driving after leaving their job will see a commensurate decrease in their insurance premiums, ensuring that they pay only for the coverage they actually need. Conversely, someone who takes on a new job requiring more driving will see a proportionate increase, but still likely a more accurate reflection of their risk than a fixed-rate policy.

Environmental Impact: Why Should You Consider Pay-Per-Mile Car Insurance In The U.S.?

Pay-per-mile car insurance offers a compelling environmental advantage by incentivizing reduced driving. This, in turn, leads to lower fuel consumption and a smaller carbon footprint, contributing to a healthier planet. The financial benefits of the insurance model directly correlate with a reduction in environmental impact.By directly linking insurance costs to mileage driven, pay-per-mile plans encourage drivers to adopt more fuel-efficient habits and consider alternative transportation options.

This shift in behavior has significant consequences for greenhouse gas emissions. Fewer miles driven translate directly into less fuel burned, leading to a reduction in the amount of carbon dioxide and other pollutants released into the atmosphere.

Reduced Greenhouse Gas Emissions

The connection between driving less and lowering greenhouse gas emissions is straightforward. Internal combustion engines, which power the vast majority of vehicles in the U.S., release significant amounts of carbon dioxide (CO2) – a primary greenhouse gas – when they burn fuel. A study by the Environmental Protection Agency (EPA) shows that transportation accounts for a significant portion of the nation’s greenhouse gas emissions.

By reducing the number of miles driven, individuals can directly contribute to a decrease in these emissions. For example, a driver who reduces their annual mileage by 5,000 miles could significantly lower their CO2 emissions, depending on their vehicle’s fuel efficiency. A reduction in driving translates directly to a reduction in greenhouse gases. The more people adopt pay-per-mile insurance, the greater the collective reduction in emissions.

Correlation Between Pay-Per-Mile Insurance and Fuel Consumption

While comprehensive studies directly correlating pay-per-mile insurance adoption with nationwide fuel consumption reductions are still emerging, anecdotal evidence and early data suggest a positive trend. Insurance companies offering pay-per-mile plans often report that their customers tend to drive less than those with traditional insurance. This is not surprising given the financial incentive to reduce mileage. Furthermore, studies focusing on similar usage-based insurance programs in other countries have shown reductions in vehicle miles traveled among policyholders.

For instance, a study in the UK showed a noticeable decrease in annual mileage among drivers who switched to a pay-per-mile insurance plan. While more research is needed to quantify the precise effect on a national scale in the U.S., the underlying principle remains: reduced driving, driven by financial incentives, directly leads to lower fuel consumption.

Technological Advancements

Pay-per-mile car insurance wouldn’t be possible without significant advancements in technology. The ability to accurately track mileage, securely transmit data, and process it efficiently is crucial to the success of these innovative insurance models. This section will explore the key technological elements driving the growth of pay-per-mile insurance.The heart of pay-per-mile insurance lies in telematics and GPS tracking. These technologies enable insurance companies to accurately measure the distance a vehicle travels, forming the basis for calculating premiums.

This precise mileage data replaces the traditional methods of estimating annual mileage, which often resulted in either overpaying or underpaying for coverage.

Mileage Tracking Methods

Insurance companies employ a variety of methods to track mileage, each with its own advantages and disadvantages. These methods prioritize accuracy and security to ensure fair and transparent pricing for consumers.

Pay-per-mile insurance can be a great way to save money, especially if you don’t drive a lot. This is particularly beneficial for teens and young adults, who often have higher insurance rates. For more tips on lowering your costs, check out this helpful guide on How to Save on Car Insurance for Teens and Young Adults in the U.S.

and then consider if pay-per-mile is right for you. Ultimately, it all boils down to finding the most cost-effective insurance option based on your driving habits.

| Mileage Tracking Method | Description | Pros | Cons |

|---|---|---|---|

| OBD-II Plug-in Device | A small device plugs into the car’s onboard diagnostics port, continuously monitoring and transmitting mileage data. | Highly accurate, real-time data, often provides additional driving data (e.g., hard braking). | Requires physical installation, potential for device malfunction or theft, may not be compatible with all vehicles. |

| Smartphone App | Utilizes the phone’s GPS to track location and calculate distance traveled. | Convenient, readily available, no additional hardware needed. | Accuracy can be affected by GPS signal strength, requires consistent smartphone usage, data privacy concerns. |

| Self-Reported Mileage | Drivers manually input their mileage at regular intervals. | Simple and inexpensive for the insurer. | Highly prone to inaccuracies and potential for fraud, relies on driver honesty. |

Eligibility and Availability

Pay-per-mile car insurance, while offering attractive benefits, isn’t universally accessible. Eligibility and availability depend on several factors determined by insurance companies, varying geographically and across different providers. Understanding these factors is crucial before considering this type of policy.Eligibility criteria are designed to assess the risk associated with insuring a driver. Insurance companies use a variety of data points to determine if a driver is a suitable candidate for a pay-per-mile plan.

This is because pay-per-mile insurance is often marketed towards low-mileage drivers, and the companies need to ensure they are accurately assessing risk to avoid losses.

Eligibility Criteria for Pay-Per-Mile Insurance

Insurance companies typically consider several factors when evaluating eligibility for pay-per-mile insurance. These criteria aim to identify drivers who are statistically less likely to be involved in accidents and who, consequently, will drive fewer miles. These factors often include:

- Driving history: A clean driving record with minimal accidents or traffic violations is usually a key requirement. A history of numerous accidents or speeding tickets could lead to ineligibility or higher premiums.

- Age and driving experience: Younger drivers or those with limited driving experience may find it more difficult to qualify, as they are statistically considered higher-risk drivers.

- Vehicle type: The type of vehicle you drive can influence eligibility. Some insurers may restrict coverage to specific vehicle types or exclude high-performance cars.

- Credit score: Similar to traditional auto insurance, a good credit score can positively impact your eligibility and premium rates. A poor credit history may make it harder to secure a pay-per-mile policy or result in higher costs.

- Address: Your address might play a role as some insurers may have limitations based on location, considering factors such as accident rates in the area.

Geographic Availability of Pay-Per-Mile Insurance

The geographic availability of pay-per-mile insurance varies across the United States. While it’s becoming increasingly common, it’s not yet offered nationwide by all insurers. Urban areas with high population densities tend to have more options than rural areas. This is due to the concentration of potential customers and the insurer’s ability to manage the risk more effectively in densely populated regions.

For example, a major insurer might offer pay-per-mile options in major metropolitan areas like New York City or Los Angeles but have limited availability in smaller towns or rural states.

Comparison of Eligibility Requirements Across Providers

Different pay-per-mile insurance providers may have slightly varying eligibility requirements. Some may be more lenient regarding driving history or credit score, while others may have stricter criteria. It’s essential to compare the eligibility requirements of several insurers before applying to find the best fit for your individual circumstances. For instance, one provider might accept drivers with a single minor accident in the past three years, while another might require a completely clean driving record for the past five years.

Similarly, the minimum age requirement or the types of vehicles covered could also vary. It’s advisable to check directly with each provider to understand their specific requirements.

Understanding the Rate Structure

Pay-per-mile car insurance, while seemingly simple, has a rate structure influenced by several factors beyond just the miles driven. Understanding these factors is key to accurately predicting your insurance costs and choosing the right plan. The base rate isn’t just a flat fee per mile; it’s a dynamic calculation.The per-mile rate isn’t a single, static number. Instead, insurers consider various factors to determine your individual cost.

Pay-per-mile car insurance can save you money if you don’t drive much. This is especially true for gig workers, and if you’re driving for Uber or Lyft, you should check out resources like The Best Car Insurance for Uber and Lyft Drivers in America to find the best coverage. Ultimately, comparing pay-per-mile options to traditional plans is key to finding the most affordable and suitable car insurance for your driving habits.

These factors interact to create a personalized premium, reflecting your specific driving profile and risk assessment. Ignoring these nuances could lead to unexpected costs.

Pay-per-mile car insurance can save you money if you don’t drive much. Finding the right coverage is crucial, especially for families, and a great resource for that is this guide on Car Insurance for Families: How to Choose the Right Coverage in America. Ultimately, choosing pay-per-mile depends on your driving habits; if you’re a low-mileage driver, it’s definitely worth exploring.

Factors Influencing Per-Mile Rates, Why Should You Consider Pay-Per-Mile Car Insurance in the U.S.?

Several key elements contribute to the final per-mile rate. These include your vehicle type (a sports car will likely have a higher rate than a compact car), your driving history (accidents and violations increase costs), your location (urban areas often have higher rates due to increased risk), and your age and credit score (similar to traditional insurance). Finally, the base rate itself varies between insurance companies.

Mileage Thresholds and Cost Impact

The number of miles you anticipate driving annually significantly impacts your overall cost. Most pay-per-mile policies have a base rate, often including a small amount of miles, and then an additional cost per mile driven above that threshold. For example, a policy might offer a base rate covering 5,000 miles annually. Driving 7,000 miles would result in additional charges for the extra 2,000 miles, while driving only 3,000 miles might result in a lower overall premium than a traditional policy.

Hypothetical Scenario: Driving Habits and Premiums

Let’s imagine two drivers, both with similar profiles (same age, vehicle type, location, and driving history), but different driving habits. Driver A drives primarily for commuting, averaging 10,000 miles annually. Driver B, a stay-at-home parent, drives significantly less, averaging only 5,000 miles a year. Both choose a pay-per-mile policy with a base rate covering 5,000 miles and a per-mile cost of $0.10 above that threshold.

Pay-per-mile insurance can be a smart choice, especially if you don’t drive much. Lower mileage means lower premiums, which is great for saving money. However, if you’ve had an accident, getting the best rates afterward is crucial; check out this guide on How to Get the Best Car Insurance Rates After an Accident in the U.S. to navigate that process.

Ultimately, pay-per-mile insurance offers flexibility and potential cost savings, making it worth considering for many drivers.

Driver A would pay for the base rate plus an additional $500 (5,000 extra miles x $0.10/mile), while Driver B would only pay for the base rate. This illustrates how significantly driving habits affect the final premium. In a traditional policy, both drivers might pay a similar premium regardless of actual mileage.

Data Privacy Concerns

Source: techcrunch.com

Pay-per-mile insurance relies heavily on the collection and analysis of driving data, raising legitimate concerns about the privacy of this information. This data, transmitted from a telematics device installed in your car, can include your location, speed, acceleration, braking patterns, and even mileage. Understanding the potential risks and the measures in place to mitigate them is crucial before opting for this type of insurance.The collection of this detailed driving data naturally raises questions about its potential misuse.

Concerns exist regarding the possibility of data breaches, unauthorized access, and the potential for insurance companies to use this information for purposes beyond calculating premiums. For example, the data could theoretically be sold to third-party marketers or used to discriminate against drivers based on their driving habits. The potential for tracking and monitoring of individual movements also raises ethical considerations for some.

Data Protection Measures by Insurance Companies

Insurance companies recognize these privacy concerns and typically implement various measures to safeguard driver data. These measures often include data encryption during transmission and storage, robust security systems to prevent unauthorized access, and adherence to relevant data privacy regulations like the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR) in Europe. Many companies also clearly Artikel their data privacy policies, explaining how data is collected, used, and protected.

Pay-per-mile car insurance can save you money if you don’t drive much, especially relevant with rising premiums. This is particularly important when considering the specific insurance needs of electric vehicles, as detailed in this helpful guide: What to Know About Car Insurance for Electric Vehicles in the U.S.. Ultimately, understanding your driving habits is key to finding the best and most affordable car insurance option for you.

They may also provide drivers with the option to control the type and amount of data collected, offering transparency and allowing for a degree of customization. For example, some companies might allow drivers to opt out of sharing certain data points, such as precise location information.

Comparison of Data Privacy Policies

A direct comparison of data privacy policies across different pay-per-mile insurance providers requires a thorough review of each company’s specific policies. These policies are often available on the insurer’s website and can vary significantly. Some providers may be more transparent about their data practices than others, providing more detail on the types of data collected, how long it is stored, and the security measures in place.

It’s crucial to compare these policies carefully before choosing a provider, paying attention to aspects such as data retention periods, data sharing practices with third parties, and the procedures for data access and correction. For instance, one provider might offer a shorter data retention period than another, or allow drivers to easily download a copy of their data.

This careful comparison allows consumers to make informed decisions aligned with their individual privacy preferences.

Comparison with Traditional Insurance Models

Choosing between pay-per-mile (PPM) and traditional car insurance hinges on your driving habits and financial priorities. Both offer coverage, but their pricing structures differ significantly, leading to advantages in specific situations. Understanding these differences is crucial for making an informed decision.Traditional car insurance uses a fixed annual premium based on factors like your age, driving history, location, and the type of car you drive.

PPM insurance, on the other hand, charges you based on the number of miles you drive each year. This means that low-mileage drivers could potentially save significantly compared to a traditional policy.

Advantages and Disadvantages of Each Model

Traditional insurance provides predictable monthly payments, making budgeting easier. However, it can be costly for low-mileage drivers who pay for coverage they don’t fully utilize. PPM insurance, conversely, offers potential cost savings for those who drive less, but the monthly premium may fluctuate depending on mileage. This lack of predictability could be a drawback for some.

Situations Favoring Each Insurance Type

Traditional car insurance is often a better fit for high-mileage drivers or those whose driving habits are less predictable. For example, a salesperson who travels extensively for work would likely find traditional insurance more cost-effective. Conversely, retirees or individuals who primarily use their car for short commutes and occasional errands might find significant savings with PPM insurance. Someone who only drives their car a few thousand miles annually would benefit more from a pay-per-mile policy.

Key Differences Summarized

| Feature | Traditional Insurance | Pay-Per-Mile Insurance |

|---|---|---|

| Premium Calculation | Fixed annual premium based on various factors | Variable premium based on annual mileage |

| Cost for Low-Mileage Drivers | Potentially expensive | Potentially less expensive |

| Cost for High-Mileage Drivers | Potentially less expensive | Potentially more expensive |

| Predictability | High | Lower |

Future Trends in Pay-Per-Mile Insurance

Pay-per-mile insurance, already a growing segment of the auto insurance market, is poised for significant transformation in the coming years. Technological advancements and evolving driver behaviors will reshape the industry, leading to more personalized, efficient, and potentially affordable coverage options. The future of pay-per-mile insurance is dynamic and driven by innovation.The integration of telematics and advanced data analytics will play a crucial role in shaping the future of this insurance model.

This will allow for even more precise risk assessment and personalized pricing, further refining the already existing system. Furthermore, the increasing adoption of electric and autonomous vehicles will present both challenges and opportunities for insurers, requiring adaptation of existing models.

Increased Use of Telematics and Data Analytics

Telematics devices, already widely used in pay-per-mile insurance, will become even more sophisticated. Expect to see advancements in data collection, including more accurate measurements of driving behavior like speed, acceleration, braking, and cornering. This granular data will allow insurers to create even more finely tuned risk profiles for individual drivers, leading to more personalized pricing. For example, a driver with consistently safe driving habits might receive significantly lower premiums compared to a driver with a history of risky maneuvers, even if they drive the same mileage.

Advanced analytics will also enable the detection of potential vehicle malfunctions or safety issues, potentially leading to proactive maintenance recommendations and reduced accident rates.

Impact of Autonomous Vehicles

The rise of autonomous vehicles presents a unique challenge and opportunity for pay-per-mile insurance. While the potential for fewer accidents due to improved safety features is significant, the traditional metrics used to assess risk may become less relevant. Insurers will need to adapt their pricing models to consider factors like the level of vehicle automation, the manufacturer’s safety record, and the performance of the vehicle’s autonomous driving system.

For instance, a fully autonomous vehicle with a proven safety record might qualify for a substantially lower per-mile rate than a manually driven vehicle. The shift could lead to insurance models based on factors beyond driver behavior, such as vehicle performance and manufacturer liability.

Personalized Pricing and Usage-Based Insurance

Pay-per-mile insurance is already moving towards more personalized pricing, but this trend will accelerate. Expect to see more granular pricing models that take into account not just mileage, but also time of day, location, and even weather conditions. For example, a driver who predominantly commutes during off-peak hours might receive a lower rate than someone who frequently drives during rush hour.

Similarly, drivers in areas with higher accident rates might see higher per-mile premiums. This heightened personalization will require sophisticated algorithms and robust data analysis capabilities, but will ultimately lead to more equitable and transparent pricing.

Integration with Other Services

We can anticipate the integration of pay-per-mile insurance with other services, such as roadside assistance, vehicle maintenance, and even ride-sharing platforms. This integration could create bundled packages that offer comprehensive coverage and convenience at a competitive price. For example, a driver might be able to purchase a package that includes pay-per-mile insurance, roadside assistance, and regular vehicle maintenance checks all through a single provider.

This would simplify the process of managing vehicle-related expenses and potentially offer significant cost savings.

Ultimate Conclusion

Ultimately, the decision of whether to switch to pay-per-mile car insurance depends on your individual circumstances. If you’re a low-mileage driver who values flexibility and potential cost savings, it’s definitely worth exploring. By carefully weighing the pros and cons, understanding the rate structure, and addressing any privacy concerns, you can make an informed choice that best suits your needs and driving habits.

Remember to compare different providers and their offerings to ensure you’re getting the best deal.

Quick FAQs

What if I drive more miles than expected one month?

Most pay-per-mile plans adjust your premium accordingly. You’ll pay more for that month, but it’s still likely cheaper than a traditional policy if your overall annual mileage remains low.

How accurate is the mileage tracking?

Accuracy varies by provider and technology used. Many use telematics devices or smartphone apps that track your mileage with GPS. Some offer manual mileage reporting as well.

Can I switch back to traditional insurance?

Yes, most providers allow you to switch back to a traditional policy at any time, though there may be a waiting period.

Is my driving data shared with third parties?

Check the provider’s privacy policy. Reputable companies have robust data security measures, but it’s important to understand how your data is used and protected.